The 50/30/20 Rule: A Simple Guide to Budgeting

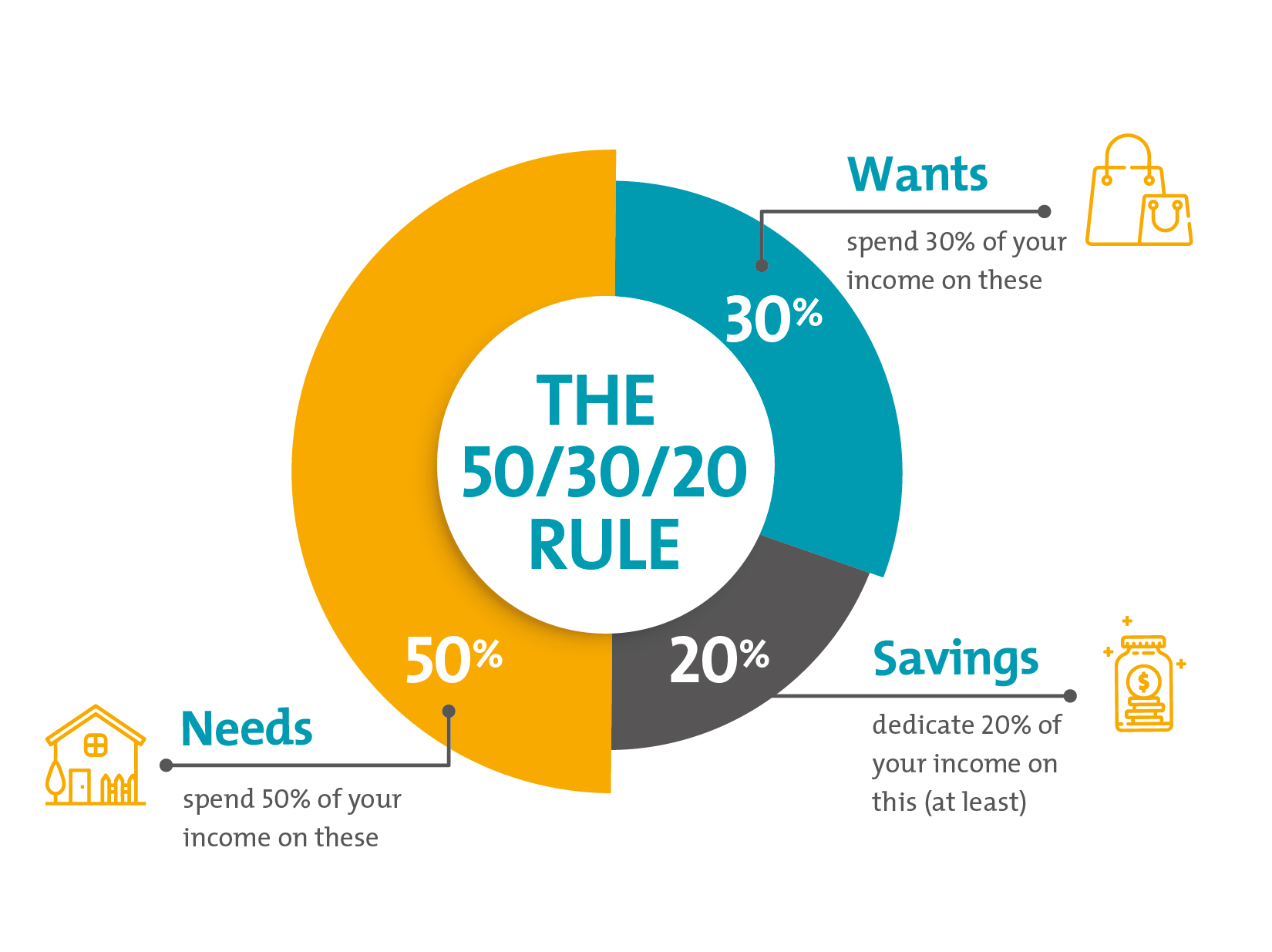

When it comes to managing your finances, it’s easy to get overwhelmed with budgeting, saving, and spending. However, the 50/30/20 rule provides a simple and effective framework for budgeting that can help you maintain a balanced financial life. It’s an approach designed to allocate your income into three essential categories: needs, wants, and savings. Here’s how it works and how you can apply it to your personal finance strategy.

What is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting guideline that divides your after-tax income into three categories:

- 50% Needs: Essential expenses that are unavoidable and necessary for survival.

- 30% Wants: Non-essential spending that enhances your lifestyle but isn’t crucial.

- 20% Savings & Debt Repayment: Setting aside money for your future financial health, which includes savings, investments, and repaying debts.

Let’s break down each category:

1. 50% for Needs: Essentials

This category covers all your must-have expenses. These are the things you absolutely cannot live without, such as:

- Housing: Rent or mortgage payments, utilities, property taxes.

- Transportation: Car payments, public transportation, insurance, fuel.

- Food: Groceries and necessary meal expenses.

- Healthcare: Health insurance, medical expenses, prescriptions.

- Insurance: Basic insurance policies like life and home insurance.

- Childcare and Education: School fees, daycare, or any educational expenses for dependents.

These are the fundamental expenses required for your day-to-day living and well-being.

2. 30% for Wants: Non-Essential Lifestyle Choices

The “wants” category includes the things that enhance your life but aren’t essential to survival. They are discretionary expenses that you can live without if necessary. Some common examples include:

- Dining Out: Restaurants, cafes, and takeout.

- Entertainment: Movies, concerts, sporting events, subscriptions to streaming services.

- Travel: Vacations, weekend trips, or other leisure travel.

- Shopping: Clothing, gadgets, or other non-essential items.

- Hobbies and Activities: Anything that adds joy to your life, like gym memberships or playing a sport.

These items are not vital for day-to-day living, but they help make life enjoyable.

3. 20% for Savings and Debt Repayment: Building Your Future

The final 20% of your budget is dedicated to securing your financial future. This includes:

- Emergency Savings: Building an emergency fund that can cover at least three to six months’ worth of living expenses.

- Retirement Savings: Contributing to retirement accounts like a 401(k) or IRA to secure your financial future.

- Investments: Putting money into stocks, bonds, mutual funds, or real estate to grow your wealth over time.

- Debt Repayment: Paying off loans, credit card debt, or student loans.

Focusing on savings and debt repayment ensures that you’re building wealth, planning for retirement, and managing your current liabilities effectively.

Why is the 50/30/20 Rule Effective?

The beauty of the 50/30/20 rule lies in its simplicity. It helps you balance essential spending with non-essential spending, while also encouraging you to save for the future. Here’s why it works:

- Clear Priorities: By clearly separating your needs, wants, and savings, it helps you prioritize what matters most.

- Flexibility: This rule can be adapted to different income levels and lifestyles. If you’re on a tight budget, you might spend less on wants and more on savings. If you have a higher income, you might allocate more to discretionary spending or investments.

- Financial Discipline: The 50/30/20 rule forces you to track your spending and make conscious decisions about how you allocate your money, promoting financial discipline.

- Long-Term Financial Health: By dedicating 20% of your income to savings and debt repayment, you’re investing in your future and reducing financial stress down the line.

How to Apply the 50/30/20 Rule

To put this rule into practice, follow these steps:

- Track Your Income: Determine your after-tax income, which is the amount you take home after taxes and deductions.

- Categorize Your Expenses: Break down your monthly expenses into needs, wants, and savings. Be honest with yourself when categorizing each expense.

- Adjust as Necessary: If you find that you’re spending too much on wants or not saving enough, consider cutting back in certain areas. For example, you could reduce dining out, cancel unnecessary subscriptions, or refinance high-interest debt.

- Automate Your Savings: Set up automatic transfers to your savings or retirement account to ensure you’re consistently putting aside 20% of your income.

Final Thoughts

The 50/30/20 rule isn’t about strict austerity; it’s about finding balance. It encourages financial responsibility without being overly restrictive. By following this simple rule, you can effectively manage your expenses, enjoy life’s pleasures, and invest in your future financial security. It’s a proven method that has helped many people take control of their money and set themselves up for long-term success.