Understanding the Rule of 72: A Simple Formula to Double Your Money

When it comes to understanding investments and returns, the Rule of 72 is a small but powerful tool that every investor should know. It’s simple, practical, and gives you a quick estimate of how long it will take for your money to double based on a fixed annual rate of return.

Let’s dive deeper into what it is, how to use it, and why it matters.

What is the Rule of 72?

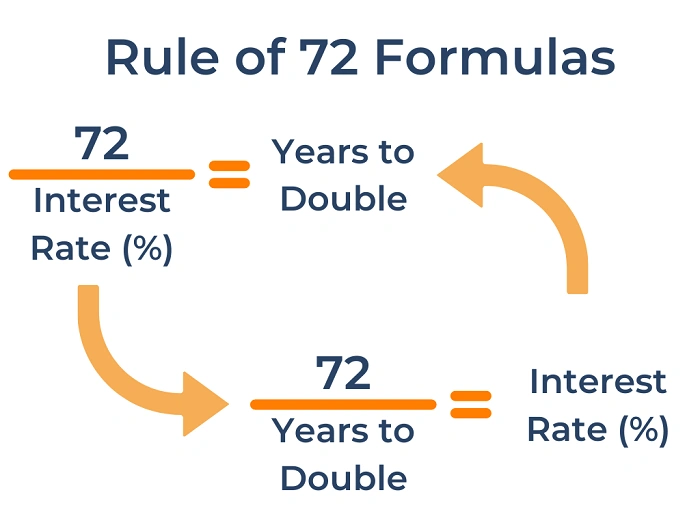

The Rule of 72 is a quick, mental math shortcut to estimate the number of years required to double your investment at a given annual rate of return.

Instead of using complex financial formulas, you just divide 72 by your annual interest rate.

The Formula:

Time to Double = 72 ÷ Annual Interest RateExample:

If your investment grows at 8% per year, then:

72 ÷ 8 = 9 yearsIt will take approximately 9 years for your investment to double.

Why 72?

You might wonder why the number 72 is used instead of, say, 70 or 75.

The answer lies in math and history. 72 gives a surprisingly accurate result for interest rates between 6% and 10%, which are common for many investments.

Also, 72 is divisible by many numbers (2, 3, 4, 6, 8, 9, and 12), making mental calculations easier.

Real-World Applications

- Investment Planning: Helps investors quickly assess the impact of different return rates.

- Loan Assessment: Shows how quickly debt can grow if not managed.

- Retirement Goals: Assists in understanding how investments might grow over time.

Some Practical Examples

| Annual Return (%) | Years to Double (72 ÷ Return) |

|---|---|

| 4% | 18 years |

| 6% | 12 years |

| 8% | 9 years |

| 12% | 6 years |

As you can see, higher returns drastically reduce the time needed to double your money.

Things to Keep in Mind

- Approximation: The Rule of 72 is an estimate, not a precise calculation.

- Taxes and Fees: Real-world returns may be lower after taxes, fees, and inflation.

- Non-Annual Compounding: The rule assumes annual compounding; different compounding frequencies can change the outcome.

A Quick Tip: Adjustments for Better Accuracy

- For lower interest rates (below 6%), use 71 instead of 72.

- For higher interest rates (above 10%), use 73.

This minor tweak makes your estimate even more precise.

Conclusion

The Rule of 72 is a timeless financial hack that simplifies the complex world of compounding. Whether you are planning investments, savings, or even looking at debts, this rule gives you an intuitive sense of how money can grow—or shrink—over time.

If you’re new to investing or helping clients plan for the future, the Rule of 72 is a great starting point for making smarter financial decisions.

Stay curious. Stay invested. Let your money work smarter, not harder!